How to Go to College For Free

College is unaffordable and taking on student loan debt isn't a smart financial choice. If you're thinking about going to college, here's how you can do so for free.

Going to college is a rite of passage and an expectation for millions of teenagers. It’s something you do to transition into adulthood.

While college is a time to take risks and learn to live on your own, it comes at a steep price. Increasingly, the cost of going to college is unaffordable for most Americans.

It’s time to have a hard conversation about the role of college in society and whether or not it’s still worth it.

Student loans have been the default option for most people who want to go to college but can’t afford to. High interest rates and a lack of good paying jobs means a student loan will take decades to pay off, if not your entire life.

Given that so much is changing in the economy, it’s unlikely students who are in college today will even be able to get jobs when they graduate.

What’s the point of going to college if it doesn’t help your job prospects and it’s only going to saddle you with a lifetime of debt?

Unless you can get 100% of your college experience paid for, I don’t think a college degree is worth it anymore. If you want to go to college, you need to work hard to not only get good grades, but to avoid going into debt on graduation day.

This article will dive into how to go to college for free. It will give you some options to consider and some strategies you can use to get your college experience completely paid for.

Why Financing College is a Terrible Idea

Before I dive in, you need to understand why you shouldn’t take on debt to get a college degree.

College is a huge investment. Yet your school isn’t equipped to help you find a job, much less give you the tools you need to eventually pay off your student loans. That’s because higher education is divorced from the economy. Your professors can’t help you get a job because they themselves have never had to look for one.

Just take a peek at their CVs to see what I mean. How many professors have worked a normal, entry-level job? Very few. They haven’t pounded the pavement looking for a job so they’re completely unaware of just how hard it is for college grads to land a job these days.

This isn’t to say college professors are lazy or don’t work hard. It’s just that the work they do isn’t applicable to the broader economy. Most professors go straight through school, earning their PhD, and eventually landing a job in academia. They teach classes, apply for grants, do research, and submit papers to journals that no one reads. They may apply for different jobs within academia, but they’re largely engaging in a closed ecosystem that is completely cut off from the rest of the economy.

Your school’s career office isn’t much better. Colleges are in the business of recruiting students, retaining them for four years, and charging tuition and fees off their attendance. They’re not in the business of helping you find a job.

Sure, schools may offer career services as a way to sell the college experience they offer but very few people working in those offices have experience in the real economy. All they can do is look over your resume, tell you how good you are, and recommend you join Handshake (or some equivalent third-party job platform) to look for job openings.

The whole point of financing a college degree is to eventually get a good job to pay it off. If colleges are in the business of selling diplomas and if the people working in those colleges have little if any experience in the job market, how on earth are they supposed to help you find a job?

Answer: they’re not.

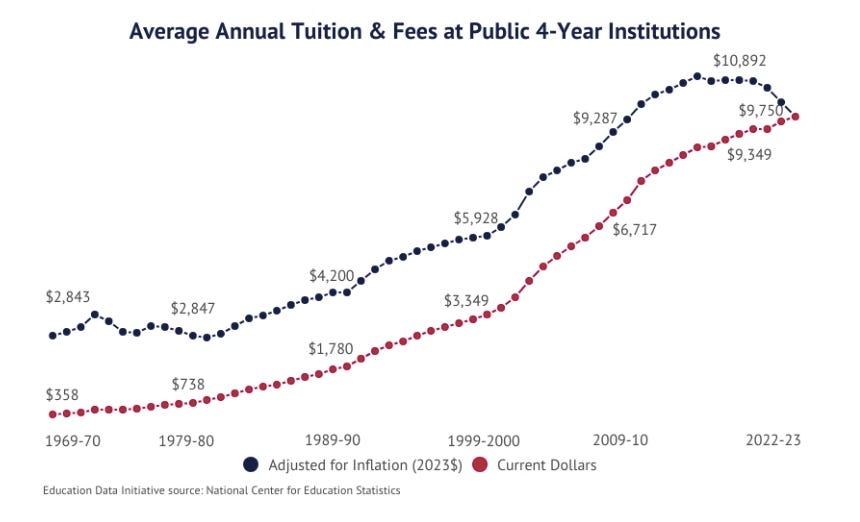

To understand the risk you’re taking, just look at previous generations who did the college experience and still have student loan debt. It’s clear as the cost of college continues to rise, outcomes aren’t improving.

In 2022, the average Gen X student loan balance was $44,240 and 30% of all student loan debt belonged to Gen X. Compare that to Millennials. 47% of all student loan debt belonged to Millennials in the same year and their average balance was $40,438.

Two generations have gone through college now and are saddled with comparable student loan balances. Whatever jobs were supposed to exist after college simply don’t. It’s reasonable to assume if a Gen Zer follows in their footsteps, they’re going to have a similar debt-ridden future too. If Gen X is still struggling to pay off their student loans, why do you think you’ll be any different?

If you’re looking at going to college – or you’re planning on sending your teenagers to college in a few years – you need to seriously start crunching some numbers. According to one survey, only 18% of Americans earn $100,000 or more per year. That means the vast majority of jobs in the market don’t pay the salaries needed to cover the cost of living AND a monthly student loan bill.

To put this in perspective, let’s say you make $80,610 per year. That’s the median income in the United States according to the latest Census data. While that might represent how much you make on paper, that’s not what you’ll make in reality. After Uncle Sam takes his cut, you can expect your actual take home income to be closer to $65,000. That means per month, your cash flow – the amount of money coming into your bank account – will be about $5,417.

That might seem like a lot of money when you’re 22 but it’s really not. You’ll probably earn less than that during your first few years out of college. By the time you’re in your early 30s and you want to buy a home, settle down, and start a family, $5,000 a month isn’t going to get you very far.

There’s all these assumptions that college equals financial security and stability later on in life but that’s clearly not true. While that is certainly the case for some careers, that isn’t what most college grads can expect. If you take out student loans, expect a lifetime of debt and hardship to follow.

The sad part is you don’t need a college degree to do most jobs anyways. You just need to show up, pay attention, and be 1% better than everyone else.

That’s why it’s time to rethink college. The value proposition of what it used to be isn’t what it is now. Instead of starting their adult lives in debt, teenagers need to consider all of their options.

That being said, just because college is expensive and doesn’t mean you need to skip college altogether. You just need to avoid paying for it.

If you want to go to school, by all means go to school. Just don’t finance it. Get creative and find ways to go to college for free.

Go to a Tuition Free College

The easiest way to go to college for free is to go to a tuition free school. Some schools that have tuition free programs include:

Massachusetts Institute of Technology

Yale University

Princeton University

Columbia University

NYU

Duke University

Rice University

Texas A&M

Texas Tech

University of Houston

Austin University

University of Texas

Alice Lloyd College

Barclay College

Berea College

College of the Ozarks

United States Air Force Academy

United States Coast Guard Academy

United States Merchant Marine Academy

United States Military Academy

United States Naval Academy

University of New Hampshire

Warren Wilson College

Webb Institute

Williamson College of the Trades

Now of course, there are caveats. Many tuition free schools have income thresholds. You have to come from a low-income family that meets the threshold to qualify.

Some tuition free programs are part of public university systems and are only available to residents of specific states. If you don’t live in Texas, for example, don’t expect to go to UT for free.

You might have noticed some schools on this list are very hard to get into. Even if you meet all of the requirements to qualify for free tuition at MIT, you still have to get in.

For a full list of tuition free programs by state, check out this website.

Earn a Ton of Scholarships

There’s a ton of free money out there to help you graduate school debt free. You just have to put in a little work to get it.

Scholarships and grants can be used to cover your college expenses and don’t require you to pay them back when you graduate.

There are a ton of scholarship databases out there where you can find scholarships to apply to. Some of the best ones include:

Before you start applying to scholarships all willy nilly, come up with a game plan. Do some research to figure out what the cost of attendance is going to be at your dream school. Figure out how much money you need to raise to cover four years of school. Keep in mind that going to college at a private university in a big city is going to be more expensive than going to a state school in the middle of nowhere.

Let me use my alma mater as an example. I graduated from Syracuse University in 2013. The total cost of attendance including tuition and housing is about $85,00 per year. (To further emphasize why you should not finance a college degree, tuition at Syracuse is currently $63,000. When I graduated it was $32,000. In a decade tuition doubled. Did incomes double in that same period of time? NOPE.)

If I were to enroll at Syracuse today, I would need $340,000. Of course, this doesn’t include financial aid, but if you’re applying to scholarships while you’re still in high school, you won’t know what your financial aid package looks like. Plan for the worst and earn more scholarship money than you’ll realistically need.

Start applying to scholarships as soon as possible. Be strategic about your approach. While merit-based scholarships are great, they are incredibly competitive. Find a balance between high-valued scholarships and less competitive ones. To go to a school like Syracuse for free, you need 340 scholarships valued at $1,000 each. That’s a lot of scholarships, but if you can pull it off, it’s worth it.

For some motivation, Google “students who win $1 million in scholarships” and you’ll find tons of stories of kids who have won enough scholarships to set them up for life. If they can do it, there’s no reason why you can’t too.

Join the Military

Going the military route isn’t a decision that should be taken lightly. But it can be a good option for someone who doesn’t quite know what they want to do with their life and thinks college is still a valuable experience to have.

Aside from applying to one of the academies, you can join the military through a ROTC program at a participating college or university. You’ll have to commit your free time to training exercises outside of classes, but the payoff could be worth it.

The Army, Navy/Marine Corps, and Air Force all offer ROTC programs. Depending on the scholarship you receive, you could get your entire tuition bill paid for. On top of that, you’ll receive stipends to cover books and school supplies as well as your cost of living.

There is a service requirement after college that varies by branch. You won’t have to hustle to find a job after you graduate but you won’t have much say over your career path either. Plus, there’s always the chance you could get deployed if we find ourselves in a state of war.

The military is an option that will allow you to graduate college debt free but there are some serious trade-offs you’ll need to consider first.

Work While You’re in School

When I say work while you’re in school, I’m not talking about taking a work-study job or picking up shifts in the dining hall. I’m talking about an actual job that generates real money you can live off of.

Working while you go to school isn’t the most fun option. But if you want to graduate debt free and have legitimate experience on your resume to show to future employers, this is a good option to consider.

Go to school part-time and let your employer foot your tuition bill. Companies like Walmart will pay you to go to school. After you graduate, if you decide to go down the management track, you could land yourself a job that pays well over six-figures.

There are trade-offs to doing this of course. An employer might not cover the degree you want to get or they might have a work requirement like the military. After you graduate you might have to commit to working with a company for a period of time as a way to “repay” the cost of going to school.

Another option is to start a business while you’re in high school and work on it around your class schedule when you’re in college. You could become a freelancer, flip stuff on eBay, or do landscaping. If you have a knack for making TikToks that go viral, I promise you there are tons of companies who would want to hire you on contract to help their marketing teams. And they’ll pay you good money if you’re good at what you do.

Whether you work for an employer or work for yourself, doing some kind of real work while you’re in school will provide essential cash flow to help cover your costs. The more money you have coming in, the less you’ll need to take out in loans. The less you need to take out in loans, the less you’ll be on the hook to pay back later on.

Other Strategies to Reduce Your College Costs

If you don’t get a full ride to your dream school that’s ok. You still have options that can help you significantly cut the cost of going to school.

Earn college credits while you’re in high school

Many high schools allow you to earn college credits before you set foot on campus. You can dual enroll with a local community college or take college credit classes like Advanced Placement or International Baccalaureate.

Every four-year college has a general education requirement. You’re going to have to take classes that have nothing to do with your major. If you can knock those out of the way before you go to school, you’ll save on tuition and reduce the amount of time you need to spend in college in the first place.

My high school offered AP tests as well as classes dual enrolled with the local community college. I earned as many college credits as I could, even sitting for AP exams that my school didn’t offer a class for. I entered college as a sophomore. Had I thought about the cost of college back then, I could have graduated in two years and probably wouldn’t be in debt right now.

The one trade-off you’ll want to consider is transfer credit limits. I entered college with more credits than my school would accept. Each university has a different transfer policy. Make sure you know what your school’s policy is so you can figure out 1) how much college you actually need to do and 2) what the total cost will be.

House hack

One of the best things you can do to set yourself up for success is to buy property as soon as possible. If you don’t understand why, go play Monopoly and pay close attention to the rules of the game.

While you’re still in high school, get a job. With most fast food joints paying $15 or more per hour you can actually make decent money working a part-time job these days.

Use your job to start saving for a down payment on a house. As a first-time homebuyer, you can qualify for a 3% down payment. If you buy a $400,000 house, that’s a $12,000 down payment. And if you qualify for an assistance program you’ll need even less than that.

For perspective, if you make $15 an hour working at McDonald’s you could have a down payment saved up after 1,000 hours of work. If you work 10 hours a week, that’s two years worth of work. That means if you get a job at 16, by the time you graduate, you could own a home.

Buy a house where you plan to go to college. Rent out the rooms to other students. Charge enough to cover your mortgage payment. You’ll zero out all of your housing costs while you're in school and you’ll graduate with equity in an asset. You can either sell it or keep it and continue generating rental income.

This isn’t going to be an option in every college town but if you can pull it off you’ll be set for life.

Become an RA

A resident advisor – or RA – is an upperclassman who mentors younger students. In exchange for looking after junior classmen, you’ll get to live on campus for free, have free meals, and in some cases receive a stipend.

Aside from tuition, your cost of living is going to be your biggest expense while you’re in school. Being an RA is an easy way to eliminate housing and meal costs., especially if you can’t afford to buy a house.

Of course, being an RA isn’t easy. You’ll have to hold students accountable to university policies and you won’t have as much privacy as you’d get living off campus. But if it means you won’t graduate with any debt it could be worth it.

Combine this with scholarships and a side hustle to eliminate all of your costs.

College isn’t necessary to land a job anymore but there are good reasons to have a college experience. You won’t have the same opportunities later in life to take risks and explore.

That being said, going into debt for a college experience isn’t worth it. You won’t get the job you think you will after you graduate, and because the cost of living continues to rise, you’re going to find life after college is unaffordable. Combine that with student loan debt and you’re going to find it hard to live the life you want to live.

Avoid student loan debt like the plague. Do whatever you can to avoid debt. Your future employer won’t care about your GPA, but future you will definitely care about paying student loan bills decades after you graduated.

Do future you a solid and skip going into debt.

Know someone who is planning on going to college soon? Share this post with them.

I was intrigued by the notion of a new college student buying a house in a college town and renting out rooms to fellow students. I asked Gemini what would be involved. (OMG, I couldn't have done this in a hundred different lifetimes!):

"An 18-year-old college freshman buying a house to rent out rooms to other students is a very ambitious undertaking! Here's a breakdown of what would be involved, highlighting the challenges and considerations:

1. Financial Considerations:

Down Payment:

This is the biggest hurdle. Most lenders require a substantial down payment, especially for investment properties (which this would be considered).

First-time homebuyer programs might offer some assistance, but these are often geared towards owner-occupied properties.

Gift funds from family are a possibility, but documentation is essential.

Credit Score:

A good credit score is crucial for obtaining a mortgage. At 18, building a strong credit history is often still in progress.

Proof of Income:

Lenders need to see a stable income stream. College students typically don't have this.

Co-signers: A parent or other responsible adult with strong credit and income might be required to co-sign the mortgage.

Business Plan: Showing a detailed business plan for the rental property, including projected income and expenses, might help.

Additional Costs:

Closing costs, property taxes, insurance, maintenance, and potential vacancy periods all factor into the overall cost.

Emergency fund: Having an emergency fund to cover unexpected repairs or vacancies is vital.

Student Loans: Existing student loan debt will be factored into the debt to income ratio, which will impact the amount of money a lender will provide.

2. Legal and Contractual Aspects:

Mortgage:

Understanding the different types of mortgages (fixed-rate, adjustable-rate) is essential.

Getting pre-approved for a mortgage is a crucial first step.

Rental Agreements:

Creating legally sound rental agreements is vital.

Understanding landlord-tenant laws in your state is crucial.

Insurance:

Landlord insurance is necessary to protect the property and yourself from liability.

Zoning and Regulations:

Check local zoning regulations for restrictions on rental properties.

Some areas have occupancy limits or require rental licenses.

3. Property Management:

Finding Tenants:

Marketing the property to students is essential.

Background checks and tenant screening are crucial.

Maintenance and Repairs:

Being prepared to handle maintenance issues is vital.

Either managing repairs yourself or hiring a property management company.

Financial Record Keeping:

Accurate records of income and expenses are necessary for tax purposes.

Time Commitment:

Being a landlord requires a significant time commitment, which can be challenging for a college student.

4. Time Management and Academic Impact:

Balancing Academics and Property Management:

Managing a rental property while attending college full-time is a significant challenge.

Time management skills are essential.

Stress Management:

Being a landlord can be stressful, especially for a young person.

Key Challenges for an 18-Year-Old:

Lack of Credit History: Building a strong credit history takes time.

Limited Income: Most college students don't have a stable, high-paying job.

Lack of Experience: Property management and real estate transactions are complex.

Time Constraints: Balancing college studies and property management is difficult.

Recommendations:

Build Credit: Start building credit early and responsibly.

Save Money: Save as much money as possible for a down payment.

Learn About Real Estate: Educate yourself about real estate investing and property management.

Seek Guidance: Talk to real estate professionals, financial advisors, and experienced landlords.

Consider Alternatives: Starting with a smaller investment, such as a rental property with a co-signer, might be a more manageable first step.

Buying a rental property at 18 is a huge undertaking. It is possible, but it will require a lot of planning, hard work, and financial backing."

Your suggestions around doing community college are so practical. In my state (NC), community college is free if attending during high school—and possibly after. And I know it is in many other states as well. That's such an easy way to get 2 years completed...which holding down a PT job or finishing up high school. It's truly a no-brainer.